Introduction:

Thailand’s central location within ASEAN and Asia in general, offers a major advantage for businesses aiming to set up data centres and cloud services. Its strategic position ensures strong connectivity to key ASEAN markets, as well as major markets including Singapore, Hong Kong, China and India.

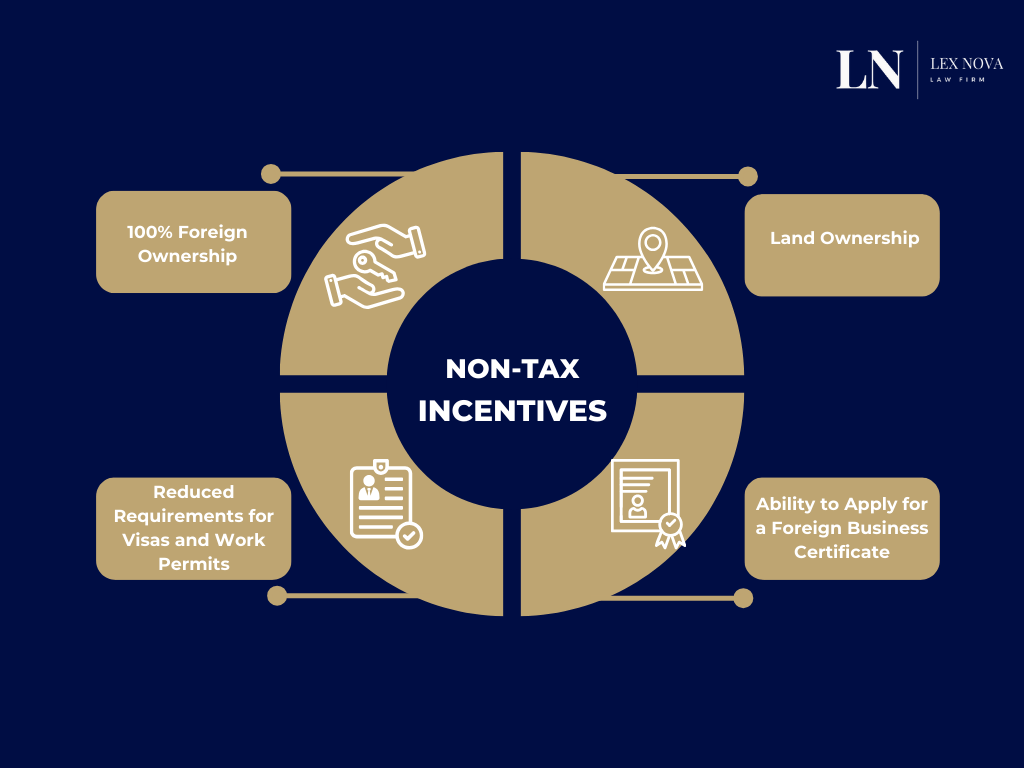

In a concentrated effort to attract more companies to establish their data centres in Thailand, the Board of Investment (BOI) has created a series of attractive incentives such as 100% foreign ownership, tax breaks, land ownership rights, and other benefits.

Thailand’s prime location, combined with attractive incentives from the Board of Investment (BOI), has been key in attracting globally renowned companies like Google, which has committed to investing $1 billion, and Amazon Web Services (AWS), to set up data centres in the country.

Key Points

- Thailand’s Board of Investment (BOI) is actively promoting investment in data centers and cloud services to support the country’s digital transformation.

- The BOI offers a range of tax and non-tax incentives for qualifying data hosting projects, including corporate income tax exemption and import duty exemption on machinery.

- Global tech companies like AWS (Amazon) and Microsoft have expressed strong interest in investing in Thailand’s data center and cloud service sectors. This comes after Google announced its commitment to invest $1 Billion in developing a cloud center in Thailand.

What is a Data Center?

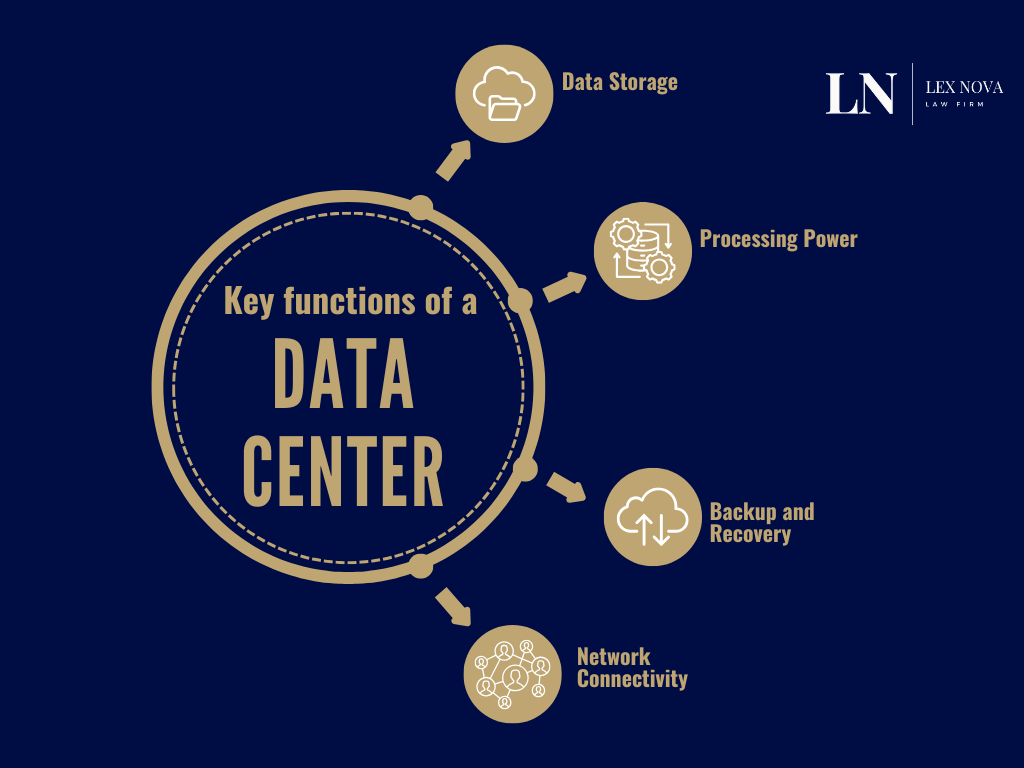

Data centers are specialized facilities that house IT infrastructure, including servers, storage systems, and networking equipment. They are designed to manage, store, and process vast amounts of data, making them essential for businesses operating in today’s digital economy.

The main features of a data center are as a follows:

- Centralized locations for storing large volumes of data securely.

- Providing the computational resources necessary for running applications and services.

- Ensuring data can be restored in case of failures or disasters.

- Facilitating communication between different systems and users.

Thailand’s Cloud First Policy

Thailand’s “Cloud First” policy is a government initiative aimed at accelerating the adoption of cloud computing across the public and private sectors. This policy is a key component of the Thailand 4.0 programme which is in itself a significant part of the Government’s attempt to turn Thailand’s economy into a high value one.

The “Cloud First” policy aims to promote the use of cloud technologies to improve efficiency, reduce costs, and drive digital transformation in key industries. The initiative supports building cloud infrastructure and services, including data centers, to position Thailand as a digital hub in Southeast Asia, aligning with broader economic and technological goals.

The Role of the BOI

The BOI has approved numerous investment projects in the data center sector, reflecting Thailand’s commitment to becoming a regional hub for digital services. So far, 37 projects have received approval, with a combined investment value exceeding 98.6 billion baht (approximately $2.8 billion). This includes significant contributions from major global companies like Amazon Web Services (AWS), Microsoft, and now Google.

Google’s recent announcement of a $1 billion investment in Thailand for data centers aligns with the country’s strategic push to enhance its digital infrastructure. This investment is part of a broader trend supported by the Thailand Board of Investment (BOI), which has been actively promoting data center and cloud service projects in the region.

Eligibility Criteria

The BOI has recently expanded its list of promoted activities to include data hosting services, which are eligible for a range of tax and non-tax incentives. To qualify for these incentives, projects must meet specific criteria including:

- having at least two data centres in Thailand that comply with ISO/IEC 27001 standards,

- an investment amount (excluding land and working capital) of at least THB 5 billion.

- projects must install an electrical system capable of supporting a minimum of two megawatts to ensure adequate power for computer equipment.

BOI Incentives Awarded to Data Centers

In order to attract companies to invest and establish data centers in Thailand, the BOI offers a series of attractive incentives including both non-tax and tax incentives.

Read Also : BOI Incentives for Renewable Energy in Thailand – Here’s What You Need to Know for 2025

General Business Incentives

The general business incentives offered to BOI promoted companies in Thailand offer companies significant advantages that are not available to non-BOI promoted companies.

Tax Incentives

Thailand offers specific tax exemptions for data centers aimed at promoting investment in the digital economy. Here are the main tax incentives available:

Value Added Tax (VAT) Exemption

As of November 9, 2022, data center operators can benefit from a VAT exemption on income derived from certain services, including:

- Provision of server space and related devices for data storage and processing.

- Data backup services to prevent data loss.

- Network connection services for internet or cloud service providers.

- System management and IT security services.

To qualify for the VAT exemption, data center operators must:

- Be a company or juristic partnership established under Thai law.

- Be registered with VAT.

- Hold a promotion in the data center business under the BOI.

Corporate Income Tax Exemption

Data centers promoted by Thailand’s Board of Investment (BOI) can receive an eight-year corporate income tax exemption with no cap on the amount. After this period, there is an additional 50% reduction for five years.

To qualify for this exemption, projects must:

- Provide services for leasing host servers for data storage.

- Have at least two data centers in Thailand that meet ISO/IEC 27001 standards.

- Make a minimum investment of THB 5 billion (excluding land and working capital).

Import Duty Exemption

Data centers are also exempt from import duties on machinery necessary for their operations, further reducing initial investment costs.

These incentives are part of Thailand’s strategic plan to become a regional digital hub and attract significant investments in data infrastructure.

Read also : Thailand’s S-Curve Industries: Driving Economic Growth & Innovation

Potential Opportunities

Thailand’s cloud-first policy presents some attractive opportunities for businesses within the cloud and data center sectors. Some potential opportunities include:

Cloud Services

The increasing demand for cloud services offers a major growth opportunity for cloud providers to broaden their offerings and target diverse market segments. By creating innovative solutions tailored to the unique needs of industries such as healthcare, finance, and manufacturing, cloud providers can enter new markets and accelerate their growth.

Development of Smart Cities

Thailand’s cloud-first policy is set to play a major role in the future of Thailand’s economy. By advancing the development of smart cities, utilizing cloud technologies to upgrade urban infrastructure and improve citizens’ quality of life, the cloud-first policy is an attractive option for businesses. By integrating cloud-based solutions into smart city projects, such as intelligent transportation systems, energy management, and public safety, Thailand aims to create sustainable, resilient, and efficient urban spaces.

For cloud providers and data center operators, this push towards smart cities offers a valuable opportunity to partner with government agencies, tech companies, and other stakeholders.

Strategic Importance

Thailand’s geographical location within ASEAN makes it an ideal hub for connecting businesses across Southeast Asia. The government’s focus on developing digital infrastructure aligns with global trends toward increased reliance on cloud services and data management solutions. The BOI’s promotion of data centers is seen as vital for supporting businesses transitioning to digital platforms and using technologies like artificial intelligence.

Google’s substantial investment in Thailand’s data center landscape highlights the country’s growing importance as a digital economy hub. Supported by the BOI’s proactive measures and incentives, this investment is expected to develop Thailand’s infrastructure, attract further foreign investment, and enhance its position in the global digital marketplace. As demand for data processing and storage continues to rise, Thailand is poised to become a key player in the region’s technological advancement.

Investment commitments from Amazon, Microsoft and Google

Thailand’s commitment to become a leading destination for Data Centers in Asia has seen the country receive significant investment from some of the world’s leading companies including:

Amazon Web Services (AWS)

Amazon Web Services (AWS) are expected to launch a new data center region in Thailand by early 2025. The investment, part of a 190 billion baht commitment through 2037, aims to support startups, enterprises, and the public sector, boosting Thailand’s digital transformation.

Google plans to invest $1 billion in data center infrastructure in Thailand, building facilities in Bangkok and Chonburi. This investment is expected to create 14,000 jobs and add $4 billion to Thailand’s GDP. The development aligns with Thailand’s “Cloud First” policy, aimed at boosting the country’s digital economy. Google’s data centers will support cloud services and AI.

Microsoft

Microsoft has committed to building its first data center in Thailand. Microsoft CEO Satya Nadella announced the development of a new Azure cloud region in Thailand, aimed at supporting the growing demand for cloud services, artificial intelligence (AI), and data privacy needs across various sectors. The investment is expected to enhance cloud services, AI capabilities, and offer advanced infrastructure to businesses and government institutions in Thailand.

FAQs about Data Centers in Thailand

What are the top data centers in Thailand?

Thailand has a strong and rapidly growing data center infrastructure. Thailand also offers a well developed subsea cable network, central location within South East Asia, and increasing demand from the digital economy make it a competitive market. Singapore still remains the leading data center hub in Southeast Asia, however, Thailand is becoming a serious competitor and is attracting major global company’s such as Google, Amazon Web Services (AWS), and Microsoft.

How does Thailand’s data center infrastructure compare to other Southeast Asian countries?

Thailand’s strategic location within ASEAN provides excellent access to regional and global markets, including Singapore, Hong Kong, China, and India. The Thai government, through the Board of Investment (BOI), offers various incentives such as 100% foreign ownership, tax breaks, land ownership rights, and import duty exemptions to encourage investment in data centers. The growing digital economy and government initiatives like Thailand 4.0 and the “Cloud First” policy further improve Thailand’s appeal.

What are the main challenges faced by data centers in Thailand?

Data centers in Thailand face several key challenges, including:

High Energy Costs and Power Supply Issues

Thailand has relatively high electricity costs compared to some neighboring countries, which can significantly impact data center operational expenses.

Climate and Cooling Challenges

The country’s tropical climate means high temperatures and humidity, increasing the need for efficient cooling systems.

Regulatory and Compliance Issues

Data centers must comply with local regulations, including the Personal Data Protection Act (PDPA), which governs data privacy.

Connectivity and Latency

While Thailand has a growing digital infrastructure, latency issues can arise due to dependence on international submarine cables.

Competition from Regional Data Center Hubs

Singapore, Malaysia, and Indonesia are strong competitors in the region, offering well-established data center ecosystems and business-friendly regulations.

Skilled Workforce Shortage

There is a shortage of highly skilled IT professionals specialized in data center operations, cloud computing, and cybersecurity.

How is the demand for data centers growing in Thailand?

The demand for data centers in Thailand is growing quickly due to the following key factors:

Increasing Digital Transformation and Cloud Adoption

Businesses in Thailand are shifting to cloud-based solutions, driving demand for data centers to host cloud services.

Expansion of 5G and IoT Infrastructure

The rollout of 5G networks is increasing the need for low-latency, high-performance data processing, pushing demand for edge computing and local data centers.

Growth in smart cities, IoT, and AI-driven applications requires strong data center infrastructure.

Strong Performing E-commerce and Fintech Sectors

The growth of e-commerce platforms like Lazada, Shopee, and TikTok Shop has led to increased data storage and processing needs.

Fintech and digital banking growth require highly secure and compliant data center solutions.

Government Support and BOI Incentives

The Board of Investment (BOI) offers tax incentives and privileges for data center investors, encouraging foreign players to set up operations in Thailand. The Thailand 4.0 policy aims to develop the country’s digital economy, further driving investment in data centers.

Increasing Demand for Data Sovereignty and Compliance

With the Personal Data Protection Act (PDPA) and other regulatory requirements, businesses prefer to store data locally rather than rely on overseas facilities.

Global cloud providers like AWS, Google Cloud, and Microsoft Azure are investing in Thai data centers to meet local demand.

Growth of Hyperscale and Colocation Data Centers

Global tech giants and regional operators are expanding in Thailand to serve Southeast Asia’s growing data needs.

Recent investments from Alibaba Cloud, STT GDC, and NTT highlight the country’s potential as a regional data hub.

What are the environmental impacts of data centers in Thailand?

Data centers in Thailand, like in other countries, have significant environmental impacts, due to high energy consumption, carbon emissions, and water usage. Here are the key environmental challenges they pose:

High Energy Consumption

Data centers require large amounts of electricity to power servers, networking equipment, and cooling systems. Thailand’s electricity grid still relies on fossil fuels, meaning data centers contribute to carbon emissions unless they use renewable energy.

Carbon Footprint and Greenhouse Gas Emissions

The use of coal and natural gas in Thailand means data centers have a high carbon footprint.Efforts to adopt green energy are increasing, but renewable energy sources like solar and wind still make up a small percentage of Thailand’s power supply.

Water Usage for Cooling

Many data centers use water-based cooling systems, consuming large amounts of fresh water. In regions prone to droughts or water shortages, excessive water use can strain local resources.

E-Waste and Resource Consumption

The replacement of hardware (servers, storage devices, cooling units) generates electronic waste (e-waste). Improper disposal of IT equipment can lead to toxic waste contamination.

Heat Emissions and Urban Heat Islands

Large data centers generate significant heat emissions, contributing to the urban heat island effect in cities like Bangkok. Without proper cooling management, this can raise local temperatures and increase air conditioning demand.